The End Of Britain

Money Week -

A little over ten years ago, we launched MoneyWeek magazine…

MoneyWeek is now the UK’s best-selling financial magazine, and serves tens of thousands of subscribers in more than 60 countries.

You may have heard of MoneyWeek because of the work we’ve done over the last several years – helping investors avoid some of the big disasters associated with the credit collapse.

We warned investors to take their money out of Europe in 2009… to avoid buying the euro… to stay away from the big banks in 2008… and steer clear of property investments in 2007.

We even helped our subscribers find opportunities to profit from the ensuing chaos, by stocking up on gold and a number of other assets unpopular at the time.

To our knowledge, no other publication can match our record of correctly anticipating and predicting the financial crisis.

But that’s not why we wrote this letter.

We cite our success and experience with the crises of the past because there is an even bigger crisis looming – something that we believe will destabilise the very foundations of Britain.

And that is why we’ve spent a significant amount of time and money in the past few months preparing this letter… perhaps the most important letter you’ll receive this year.

This looming crisis is related to the financial crisis of 2008… but it will be infinitely more dangerous. As we’ll explain, there is an unsolvable problem at the heart of our financial system. One that dates back over a hundred years.

In that time this problem has eaten away more than £10 trillion in public funds. It has been at the root of practically every major political argument in this country, and it affects every aspect of the way we live our lives.

Twenty-five Prime Ministers – from both political parties – have come and gone without ever having come close to solving it.

We believe the outcome of this problem is inevitable… and the recession, joblessness and instability you see right now is only the first stage of it. Many people think the slump we’re in now is as bad as it will get.

But the truth is, it’s only the start.

In fact, you will certainly see the consequences of this deep-rooted problem unfold across the cities, towns and villages of Britain. No one will escape the fallout.

In all recorded history, no country has ever recovered from the financial position we find ourselves in today. No government has ever been able to reverse this trend. No emergency action has ever come close to a solution.

This inescapable problem has only ever had one outcome: financial collapse.

Believe me, we don’t make this prediction lightly and we have no interest in trying to scare you. We’re simply following our research to its logical conclusion.

We did the same when we anticipated the global credit crisis, the property slide and the collapse of the banks.

That’s why, before we go any further, we need to make something clear…

This is the most serious warning we’ve ever made

This is not just about your money. Yes, at its core, money is a big part of the issue. But it goes deeper than that.

What we are going to say is controversial. It will shock many people. In fact, we anticipate an inbox full of angry emails for what we are about to reveal.

And the ideas and solutions we are going to suggest might seem somewhat radical to you at first.

Way back in 2005 – when we began warning about Britain’s dangerous debt burden – very few took us seriously… not at first. Back then, most mainstream commentators – from the Financial Times to the Daily Mail – just ignored the views we published.

People couldn’t refute our research… but they weren’t ready to accept the enormity of its conclusions either. Our guess is that, reading this, you may say that too. You’ll say: “There’s no way this could really happen… not here. Not to me.”

But consider this:

No one believed us six years ago when we predicted the oil “super spike” months before it made its 82% climb.

No one believed us five years ago, when we anticipated the slide in the pound, calling our national currency ‘Down and out’. It has since suffered a long decline and will do so for many years to come.

And no one believed us three years ago when we advised our readers to ‘SELL EUROPE’. The eurozone crisis has since devastated stock markets across the continent.

In each case we were right to issue these controversial warnings early.

Those who received our early insights – our regular readers – would have made and saved thousands from these events. They had quite an advantage.

And that brings us to today…

The same financial problems we’ve been tracking from bank to bank, from company to company for more than five years have now found their way into the heart of our financial system. We’ll explain how this came to be, because what it means is critically important to you and everyone in the country.

The next phase in this crisis could threaten our very way of life.

We predict that everything about your financial life will change: where you bank, how you store your money… when you plan to retire… the way you protect your family and home.

We’ll explain why we believe these events are about to happen. You can decide for yourself if we’re full of hot air. As for us, we are more certain about this looming crisis than we have been about anything else in our publication’s history. It makes us worry about the future for our families.

Here at MoneyWeek, we know that debts don’t just disappear. We know that bailouts have big consequences. We know that printing mountains of money can only end in disaster. And, unlike most of the pundits on TV and in the mainstream press, our analysts understand what’s really going on, and they have made a habit of getting the majority of these big calls right.

Of course, the most important part of this situation is not what is happening… but rather what you can do about it. In other words, will you be prepared when this crisis becomes a national emergency, as we predict?

We fear that most people will not know what to do if banks fold and they are unable to withdraw their savings. They won’t know what to do if the stock exchange suspends trading. They will be clueless if their pension income dries up. And if their home loses 50% of its value.

If the NHS is sold off and benefits are scrapped, the confusion will turn into rage. Media coverage will be, of course, unhelpful.

You can challenge every single one of our facts and we are confident you’ll find that we’re right about each allegation we make. Then you can decide for yourself.

Will you act now and take this chance to protect yourself and your family from the catastrophe that’s brewing right now in our financial system?

We hope so. And that’s why weI wrote this letter.

We are going to talk you through exactly what’s happening and what you can do as well. We can’t promise you’ll emerge from this potential crisis completely unharmed – but we sincerely believe you’ll be a lot better off than people who don’t follow the simple steps outlined in this letter.

But we’re getting ahead of ourselves a bit.

Let’s start at the beginning. Here’s why we are so concerned, and what we believe will happen in the very near future…

The downward slide has begun

Britain is about to be flattened by a tidal wave of debt. It doesn’t matter if you vote Conservative, Liberal, Labour, UKIP – or for no party at all. The facts are the facts.

Let’s take a look at some numbers…

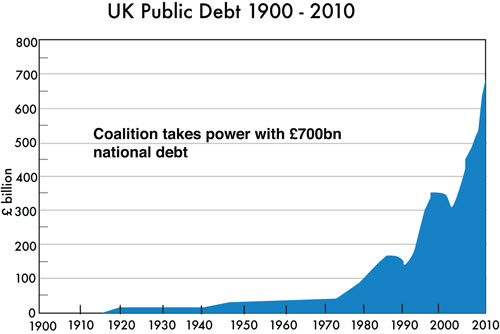

Two and a half years ago, when the Coalition government formed, we were already in a huge amount of debt. In fact, the previous government had left the country sinking under £700 billion’s worth. Take a look at the following chart:

Source: ukpublicspending.co.uk

The Coalition has spent the last two years desperately and very publically trying to get our finances in order. We’ve had an “austerity” budget. We’ve had tax hikes. We’ve had “the cuts”.

But for all that, our national debt is still growing at an incredible rate.

Despite David Cameron’s talk of “austerity”, he’s going to add an estimated £700 billion to the national debt in just five years. That’s more than Tony Blair and Gordon Brown added to the national debt in eleven years. It’s more than every British government of the past 100 years put together.

The fact is, when you look at our finances as a whole, the Coalition isn’t cutting anything. State spending is going up… our national debt is going up… and our interest payments are going up.

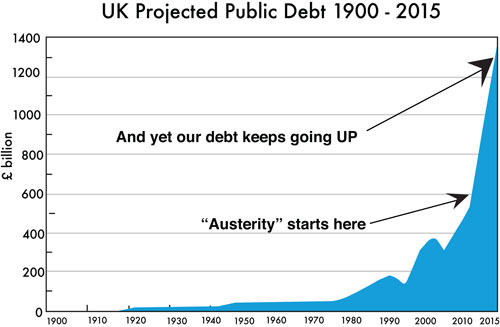

By the next general election in 2015, our national debt is estimated to stand at almost £1.4 trillion, as this chart shows:

Source: ukpublicspending.co.uk

It’s clear: our public finances are in an enormous mess. Anyone can see that. And to some extent, some politicians will admit it. But add in our financial, personal and private debts… and an even darker picture emerges…

Compared to the size of our economy, Britain is now one of the most heavily indebted countries in the Western world. That’s official. Our total debts stand at more than FIVE TIMES what our entire economy is worth.

Proportionally, that’s more debt than Italy… Portugal… Spain… and almost twice as much debt as Greece. Those are four countries already in the throes of financial crisis. We’re the odd one out because we haven’t collapsed – yet. But things can’t stay that way for long.

You see, the only countries that have more debt than us are Japan, where the economy has stagnated for 20 years and the stock market has crashed by 75%… and Ireland, where the housing market has crashed 50%, and the government has been forced to accept a bailout.

Read More: moneyweek.com

Truth good article who’s next

I don’t know about the U.K. but I do know about America. In 1956 the government took a look a social security. , they found out at it’s rate of growth it would have enough money in it to OWN America. so what did they do they passed a law that the government could borrow money from it and give it a treasury bond payable at a later date. .When Pres’ Bush said S.S, was broke the man in charge at that time said they were not and he was going to turn in some Treasury bonds. Bush said he was sorry but the government had no money so he couldn’t turn any bonds in. The next day Japan said if your own accounts can not turn your bonds in why are we buying them as the ones we have are worthless. Now for Japan. In japan they have the Japanese postal retirement fund This has so much money in it that the Japanese government keeps printing money, because they don’t care if there country goes broke, that way the pension fund will be worthless. and the people can starve.. The Elite have there interest out of the country any way