Ron Paul: ‘The situation in Cyprus should be both a lesson and a warning to the United States’

theglobaldispatch.com

Former Texas Congressman Ron Paul said today that the situation in Cyprus should serve as a lesson for Americans and asks, “How long before bureaucrat and banker try that here?”, according to a Texas Straight Talk April 1.

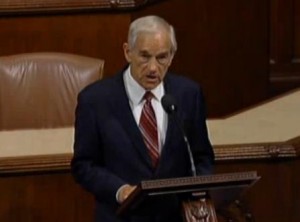

You Tube screen shot

Dr. Paul initially outlines what happened in Cyprus–”Cypriot banks invested heavily in Greek sovereign debt, and last summer’s Greek debt restructuring resulted in losses equivalent to more than 25 percent of Cyprus’ GDP. These banks then took their bad investments to the government, demanding a bailout from an already beleaguered Cypriot treasury. The government of Cyprus then turned to the European Union (EU) for a bailout.

“The terms insisted upon by the troika (European Commission, European Central Bank, International Monetary Fund) before funding the bailout were nothing short of highway robbery. While bank depositors have traditionally been protected in the event of bankruptcy or liquidation, the troika insisted that all bank depositors pay a tax of between 6.75 and 10 percent of their total deposits to help fund the bailout.”

Calling the actions of the Cypriot banks and government foolish and criminal, he asks, “Imagine the reaction if in September 2008, the US government had financed its $700 billion bank bailout by directly looting American taxpayers’ bank accounts!”

Although the country’s parliament said no to the proposal, Paul says the final proposal delivered by the EU and IMF will rule.

He reminds listeners to Texas Straight Talk that under a fractional reserve banking system only a small percentage of deposits is kept on hand for dispersal to depositors. The rest of the money is loaned out.

He says that what is happening in Cyprus is the future for bank bailouts in the EU.Could they raid other investments and pension funds. No one’s money is safe.

“Bank runs are now a certainty in future crises, as the people realize that they do not really own the money in their accounts”, Paul said.

The situation in Cyprus should be both a lesson and a warning to the United States, he admonishes. “How long before bureaucrat and banker try that here?”

Read More: theglobaldispatch.com